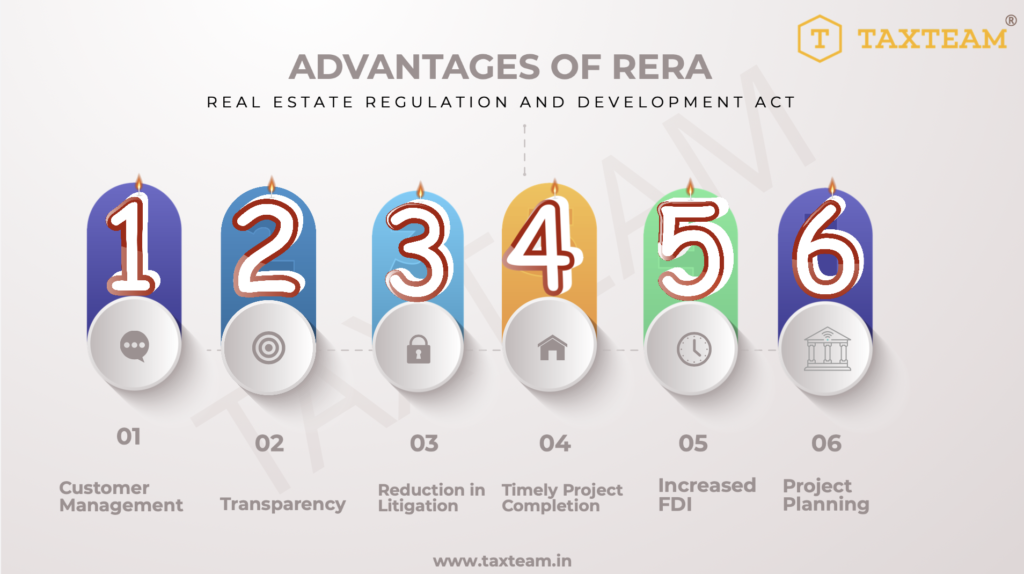

Here are the protection and benefit given under the RERA Act 2016

Real estate sector is an important pillar of the economy. However, this sector has been unregulated with absence of professionalism and lack of consumer protection. There was no specific regulator for real estate like how we have for insurance, telecom, stock markets etc. In this view, the government enforced the Real Estate (Regulation and Development) Act, 2016 (RERA Act) for protecting the interests of those who are planning to buy a house. This Act ensures transparency and efficiency in sale of an apartment, plot or building and it regulates the real estate sector.

The objects and reasons for which the Act has been framed:

1. Ensure accountability towards allottees and protect their interest

2. Infuse transparency, ensure fair-play and reduce frauds & delays

3. Introduce professionalism and pan India standardization

4. Establish symmetry of information between the promoter and allottee

5. Imposing certain responsibilities on both promoter and allottees

6. Establish regulatory oversight mechanism to enforce contracts

7. Establish fast- track dispute resolution mechanism

8. Promote good governance in the sector which in turn would create investor confidence.

The promoters/developers need to register their real estate project with the Real Estate Regulatory Authority before advertising, promoting, inviting persons to purchase or sell their real estate projects or any part of it. Thisregistration ensures that the real estate projects are genuine and protects the buyers’ interests.

The RERA Act provides the calculation of the carpet area. The developers must follow and adhere to the definition of carpet area while calculating the same. Thus, the calculation of the carpet area is uniform across India after the introduction of the RERA Act, and the promoters cannot inflate the carpet area to increase prices. The RERA Act also provides that a developer cannot take more than 10% of the project’s cost from a buyer as advance.

When there is a delay in delivering the property’s possession to the buyer, the developer must pay the same interest rate as the buyer would pay for any delay in paying the amount. Before the RERA Act, the promoter/developer paid much less interest to the buyer for the delay in handing over the possession when compared to the interest paid by the buyer for the payment delay.

The RERA Act also provides that the developers should rectify the damages in the structural defects or defects in quality within five years from handing over possession to the buyers without any cost. Where there is a mismatch in the promised property and its delivery, the buyer can recover the complete refund of the advance paid.

The buyers have the right to claim compensation from the developers if they discover a defect in the title at the time of possession. In addition, the buyers can file a complaint with the Real Estate Regulatory Authority regarding any real estate project. The buyers can also file an appeal from the Real Estate Regulatory Authority order to the appellate tribunal.