Key Updates from 43rd GST Council Meet

The 43rd GST council meet chaired by Union finance minister Mrs. Nirmala Sitharaman met after a gap of almost seven months on 28th May 2021. Some of the key updates from the council meet are provided below:

- The annual return filing for small tax payers having annual aggregate turnover upto Rs. 2 Crore is optional for the financial year 2020-21.

- The Annual return filing process has been simplified

- The reconciliation statement in Form GSTR 9C for the financial year 2020-21 has to be furnished by those having aggregate annual turnover more than Rs. 5 Crore.

- The reconciliation statement in Form GSTR 9C can be filed on Self Certified basis.

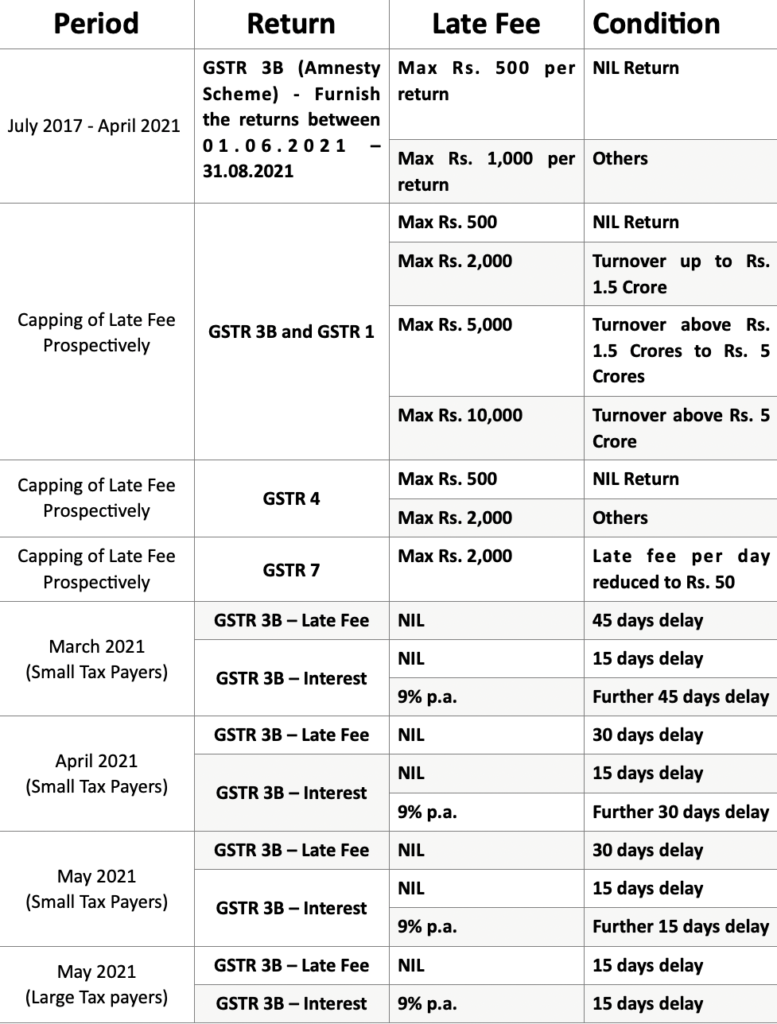

- To reduce the burden of small and medium tax payers an amnesty scheme has been introduced. Late fee for non-furnishing GSTR-3B for the tax periods from July, 2017 to April, 2021 has been reduced/waived. Provided the returns are furnished between 01.06.2021 to 31.08.2021.

- The upper cap of the late fee is being rationalized to align late fee with tax liability/turnover of the taxpayers.

Other Relaxations:

- Extension of due date of filing GSTR-1/ IFF for the month of May 2021 by 15 days.

- Extension of due date of filing GSTR-4 for FY 2020-21 to 31.07.2021.

- Extension of due date of filing ITC-04 for QE March 2021 to 30.06.2021.

- Cumulative application of rule 36(4) for availing ITC for tax periods April, May and June, 2021 in the return for the period June, 2021.

- Allowing filing of returns by companies using Electronic Verification Code (EVC), instead of Digital Signature Certificate (DSC) till 31.08.2021.

For more details please free to contact our team through phone call or WhatsApp.