Recommendations of 43rd GST Council Meeting – Extract from Ministry of Finance

The 43rd GST Council met under the Chairmanship of Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman through video conferencing here today. The meeting was also attended by Union Minister of State for Finance & Corporate Affairs Shri Anurag Thakur besides Finance Ministers of States & UTs and senior officers of the Ministry of Finance & States/ UTs.

The GST Council has made the following recommendations relating to changes in GST rates on supply of goods and services and changes related to GST law and procedure:

COVID-19 RELIEF

● As a COVID-19 relief measure, a number of specified COVID-19 related goods such as medical oxygen, oxygen concentrators and other oxygen storage and transportation equipment, certain diagnostic markers test kits and COVID-19 vaccines, etc., have been recommended for full exemption from IGST, even if imported on payment basis, for donating to the government or on recommendation of state authority to any relief agency. This exemption shall be valid upto 31.08.2021. Hitherto, IGST exemption was applicable only when these goods were imported “free of cost” for free distribution. The same will also be extended till 31.8.20201. It may be mentioned that these goods are already exempted from Basic Customs duty. Further in view of rising Black Fungus cases, the above exemption from IGST has been extended to Amphotericin B.

Further relief in individual item of COVID-19 after Group of Ministers (GoM) submits report on 8th June 2021

● As regards individual items, it was decided to constitute a Group of Ministers (GoM) to go into the need for further relief to COVID-19 related individual items immediately. The GOM shall give its report by 08.06.2021.

OTHER RELIEFS ON GOODS

- To support the LympahticFilarisis (an endemic) elimination programme being conducted in collaboration with WHO, the GST rate on Diethylcarbamazine (DEC) tablets has been recommended for reduction to 5% (from 12%).

- Certain clarifications/clarificatory amendments have been recommended in relation to GST rates. Major ones are, – Leviability of IGST on repair value of goods re-imported after repairsGST rate of 12% to apply on parts of sprinklers/ drip irrigation systems falling under tariff heading 8424 (nozzle/laterals) to apply even if these goods are sold separately.

- SERVICES

- To clarify those services supplied to an educational institution including anganwadi(which provide pre-school education also), by way of serving of food including mid- day meals under any midday meals scheme, sponsored by Government is exempt from levy of GST irrespective of funding of such supplies from government grants or corporate donations.

- To clarify these services provided by way of examination including entrance examination, where fee is charged for such examinations, by National Board of Examination (NBE), or similar Central or StateEducational Boards, and input services relating thereto are exempt from GST.

- To make appropriate changes in the relevant notification for an explicit provision to make it clear that land owner promoters could utilize credit of GST charged to them by developer promoters in respect of suchapartments that are subsequently sold by the land promotor and on which GST is paid. The developer promotor shall be allowed to pay GST relating to such apartments any time before or at the time of issuance of completion certificate.

- To extend the same dispensation as provided to MRO units of aviation sector to MRO units of ships/vessels so as to provide level playing field to domestic shipping MROs vis a vis foreign MROs and accordingly, –

- GST on MRO services in respect of ships/vessels shall be reduced to 5% (from 18%).

- PoS of B2B supply of MRO Services in respect of ships/ vessels would be location of recipient of service

- To clarify that supply of service by way of milling of wheat/paddy into flour (fortified with minerals etc. by millers or otherwise )/rice to Government/ local authority etc.for distribution of such flour or rice under PDS is exempt from GST if the value of goods in such composite supply does not exceed 25%. Otherwise, such services would attract GST at the rate of 5% if supplied to any person registered in GST, including a person registered for payment of TDS.

- To clarify that GST is payable on annuity payments received as deferred payment for construction of road. Benefit of the exemption is for such annuities which are paid for the service by way of access to a road or a bridge.

- To clarify those services supplied to a Government Entity by way of construction of a rope-way attract GST at the rate of 18%.

To clarify that services supplied by Govt. to its undertaking/PSU by way of guaranteeing loans taken by such entity from banks and financial institutions is exempt from GST.

MEASURES FOR TRADE FACILITATION:

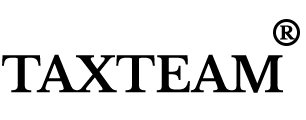

1. Amnesty Scheme to provide relief to taxpayers regarding late fee for pending returns:

To provide relief to the taxpayers, late fee for non-furnishing FORM GSTR-3B for the tax periods from July, 2017 to April, 2021 has been reduced / waived as under: –

i. late fee capped to a maximum of Rs 500/- (Rs. 250/- each for CGST & SGST) per return for taxpayers, who did not have any tax liability for the said tax periods;

ii. late fee capped to a maximum of Rs 1000/- (Rs. 500/- each for CGST & SGST) per return for other taxpayers;

The reduced rate of late fee would apply if GSTR-3B returns for these tax periods are furnished between 01.06.2021 to 31.08.2021.

2. Rationalization of late fee imposed under section 47 of the CGST Act:

To reduce burden of late fee on smaller taxpayers, the upper cap of late fee is being rationalised to align late fee with tax liability/ turnover of the taxpayers, as follows:

A. The late fee for delay in furnishing of FORM GSTR-3B and FORM GSTR-1 to be capped, per return, as below:

(i) For taxpayers having nil tax liability in GSTR-3B or nil outward supplies in GSTR- 1, the late fee to be capped at Rs 500 (Rs 250 CGST + Rs 250 SGST)

(ii) For other taxpayers:

1. For taxpayers having Annual Aggregate Turnover (AATO) in preceding year upto Rs 1.5 crore, late fee to be capped to a maximum of Rs 2000 (1000 CGST+1000 SGST);For taxpayers having AATO in preceding year between Rs 1.5 crore to Rs 5 crore, late fee to be capped to a maximum of Rs 5000 (2500 CGST+2500 SGST);For taxpayers having AATO in preceding year above Rs 5 crores, late fee to be capped to a maximum of Rs 10000 (5000 CGST+5000 SGST).

B. The late fee for delay in furnishing of FORM GSTR-4 by composition taxpayers to be capped to Rs 500 (Rs 250 CGST + Rs 250 SGST) per return, if tax liability is nil in the return, and Rs 2000 (Rs 1000 CGST + Rs 1000 SGST) per return for others.

C. Late fee payable for delayed furnishing of FORM GSTR-7 to be reduced to Rs.50/- per day (Rs. 25 CGST + Rs 25 SGST) and to be capped to a maximum of Rs 2000/- (Rs. 1,000 CGST + Rs 1,000 SGST) per return.

All the above proposals to be made applicable for prospective tax periods.

3. COVID-19 related relief measures for taxpayers:

In addition to the relief measures already provided to the taxpayers vide the notifications issued on 01.05.2021, the following further relaxations are being provided to the taxpayers:

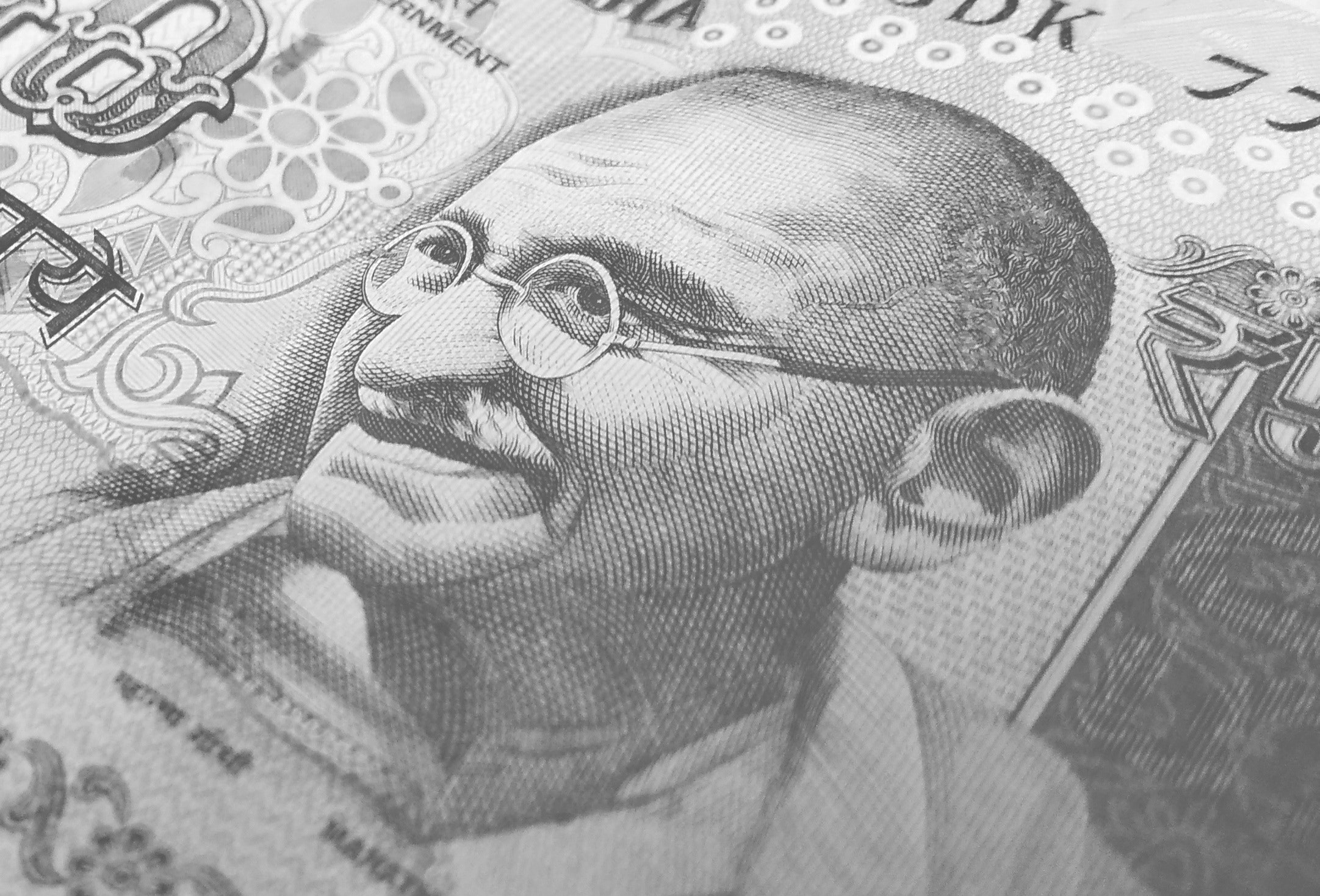

A. For small taxpayers (aggregate turnover upto Rs. 5 crore) March & April 2021 tax periods:

i. NIL rate of interest for first 15 days from the due date of furnishing the return in FORM GSTR-3B or filing of PMT-06 Challan, reduced rate of 9% thereafter for further 45 days and 30 days for March,2021 and April, 2021 respectively.

ii. Waiver of late fee for delay in furnishing return in FORM GSTR-3B for the tax periods March / QEMarch, 2021 and April 2021 for 60 days and 45 days respectively, from the due date of furnishing FORM GSTR-3B.

iii. NIL rate of interest for first 15 days from the due date of furnishing the statement in CMP-08 by composition dealers for QE March 2021, and reduced rate of 9% thereafter for further 45 days.

* For May 2021 tax period:

i. NIL rate of interest for first 15 days from the due date of furnishing the return in FORM GSTR-3B or filing of PMT-06 Challan, and reduced rate of 9% thereafter for further 15 days.

ii. Waiver of late fee for delay in furnishing returns in FORM GSTR-3B for taxpayers filing monthly returns for 30 days from the due date of furnishing FORM GSTR-3B.

B. For large taxpayers (aggregate turnover more than Rs. 5 crore)

i. A lower rate of interest @ 9% for first 15 days after the due date of filing return in FORM GSTR-3B for the tax period May, 2021.

ii. Waiver of late fee for delay in furnishing returns in FORM GSTR-3B for the tax period May, 2021 for 15 days from the due date of furnishing FORM GSTR-3B.

C. Certain other COVID-19 related relaxations to be provided, such as

1. Extension of due date of filing GSTR-1/ IFF for the month of May 2021 by 15 days.Extension of due date of filing GSTR-4 for FY 2020-21 to 31.07.2021.Extension of due date of filing ITC-04 for QE March 2021 to 30.06.2021.Cumulative application of rule 36(4) for availing ITC for tax periods April, May and June, 2021 in the return for the period June, 2021.Allowing filing of returns by companies using Electronic Verification Code (EVC), instead of Digital Signature Certificate (DSC) till 31.08.2021.

D. Relaxations under section 168A of the CGST Act: Time limit for completion of various actions, by any authority or by any person, under the GST Act, which falls during the period from 15th April, 2021 to 29th June, 2021, to be extended upto 30th June, 2021, subject to some exceptions.

[Wherever the timelines for actions have been extended by the Hon’ble Supreme Court, the same would apply]

4. Simplification of Annual Return for Financial Year 2020-21:

i. Amendments in section 35 and 44 of CGST Act made through Finance Act, 2021 to be notified. This would ease the compliance requirement in furnishing reconciliation statement in FORM GSTR-9C, as taxpayers would be able to self-certify the reconciliation statement, instead of getting it certified by chartered accountants. This change will apply for Annual Return for FY 2020-21.

ii. The filing of annual return in FORM GSTR-9 / 9A for FY 2020-21 to be optional for taxpayers having aggregate annual turnover upto Rs 2 Crore;

iii. The reconciliation statement in FORM GSTR-9C for the FY 2020-21 will be required to be filed by taxpayers with annual aggregate turnover above Rs 5 Crore.

5. Retrospective amendment in section 50 of the CGST Act with effect from 01.07.2017, providing for payment of interest on net cash basis, to be notified at the earliest.

OTHER MEASURES

i. GST Council recommended amendments in certain provisions of the Act so as to make the present system of GSTR-1/3B return filing as the default return filing system in GST.

Note: The recommendations of the GST Council have been presented in this release in simple language for information of all stakeholders. The same would be given effect through relevant Circulars/Notifications which alone shall have the force of law.